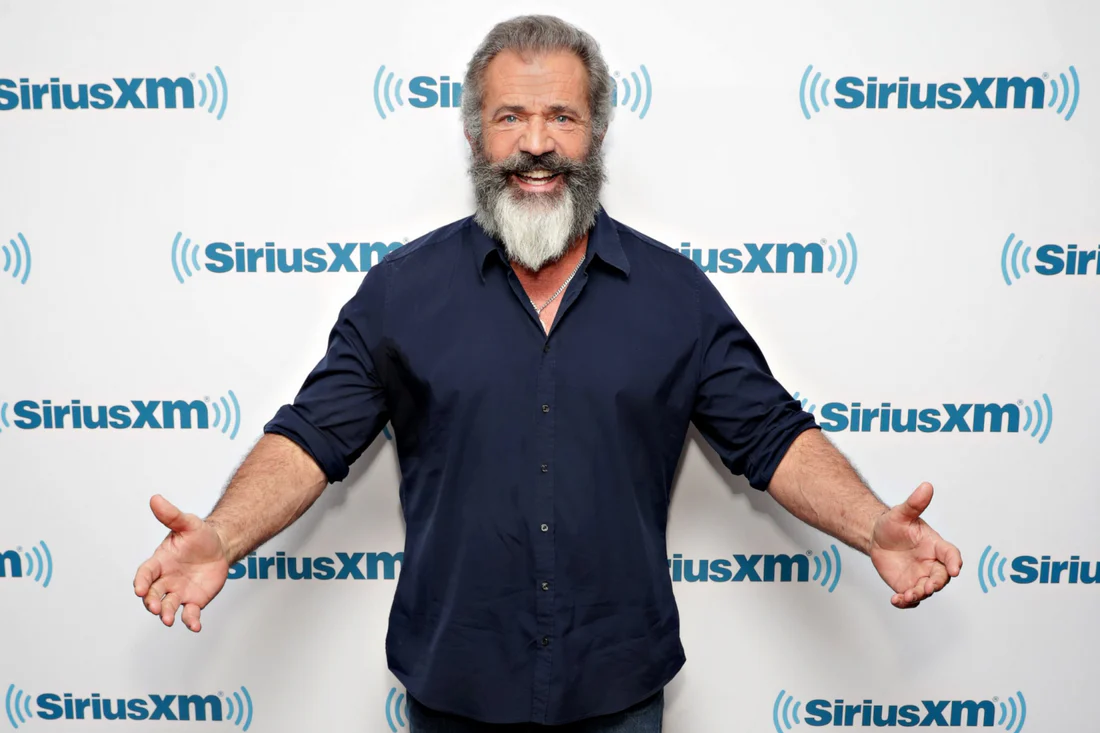

Mel Gibson’s high-profile divorce from Robyn Moore in 2011 not only made headlines for its jaw-dropping $425 million settlement but also secured its place as the fifth largest divorce payout in U.S. history. While Gibson’s split is noteworthy, it’s just one of many instances where the dissolution of a marriage has had staggering financial repercussions, particularly among those linked to prominent family offices.

Gibson’s divorce settlement was a result of a 30-year marriage and was compounded by the fact that there was no prenuptial agreement in place. This hefty price tag, however, is dwarfed by even more astronomical settlements involving other high-net-worth individuals and family offices.

For instance, the Bezos divorce in 2019, involving Amazon founder Jeff Bezos and his wife MacKenzie Scott, remains the most expensive divorce settlement to date. The couple’s separation resulted in Scott receiving approximately $38 billion in Amazon stock. This historic split had a significant impact on Bezos’s wealth but also demonstrated the massive financial stakes involved when billion-dollar family offices and fortunes are divided.

The Adelson family office also found itself in the spotlight when Miriam Adelson, wife of the late casino magnate Sheldon Adelson, negotiated her divorce settlement. Though the exact figures remain undisclosed, it is believed to be in the billions, reflecting the vast wealth managed by the family’s private office. Miriam Adelson remarked, “Our focus has always been on philanthropy and our businesses. While this personal chapter is challenging, our commitment to our causes remains unwavering.”

Another notable divorce involved oil tycoon Harold Hamm, whose split from Sue Ann Arnall resulted in a $975 million settlement. Hamm’s family office, which oversees substantial oil and gas investments, faced a significant reshuffling of assets. Hamm commented on the settlement, “While the financial aspects are substantial, our priority remains the stability and growth of our family business.”

Prominent family offices are often intertwined with significant divorce settlements, as seen in the Murdoch family. Rupert Murdoch’s split from his second wife, Anna, resulted in a $1.7 billion settlement. The division of assets from the Murdoch family office, which includes extensive media holdings, showcased the complex interplay of personal and business finances.

As these cases illustrate, divorce can have profound financial implications, particularly for those managing vast family fortunes. The settlements not only affect the individuals involved but also the operations and strategic decisions of their family offices. These high-stakes splits underscore the importance of careful financial planning and the potential impact of personal relationships on the world’s wealthiest families.