Client Spotlight – The Latin American Art Fund

Paul Hollingworth, a veteran British Investment Banker and financial analyst, is bristling with energy about a new US$50million Latin American Art fund. “I am combining my two passions, art and investment”.

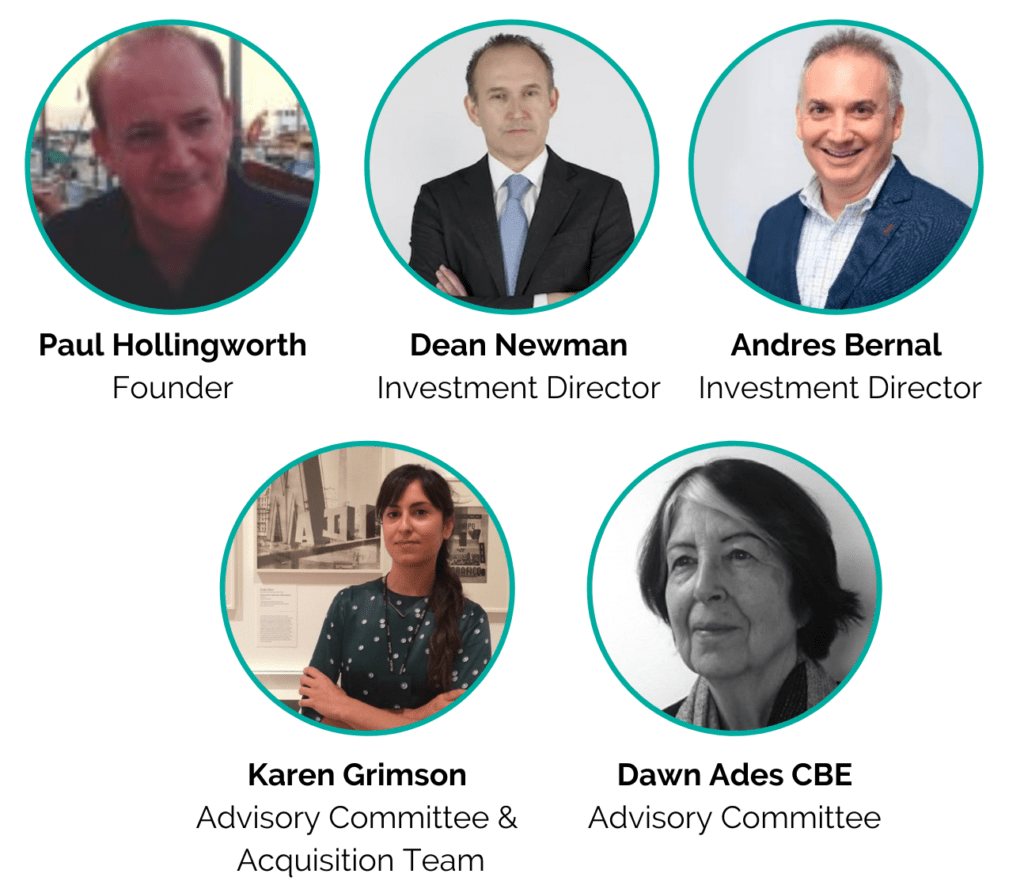

Hollingworth has assembled a blue-chip board of directors with a combined 75 years of asset and risk management experience. The high quality advisory committee, which will contribute forcefully to the acquisition strategy, includes Dawn Ades CBE (Commander of the Order of the British Empire) and curatorial expert, Karen Grimson. “Dawn knows about all that needs to be known about art history, from Dali to the Mexican muralists, while Karen has extensive curator experience in Torres Garcia at MoMA and in Colombia.”

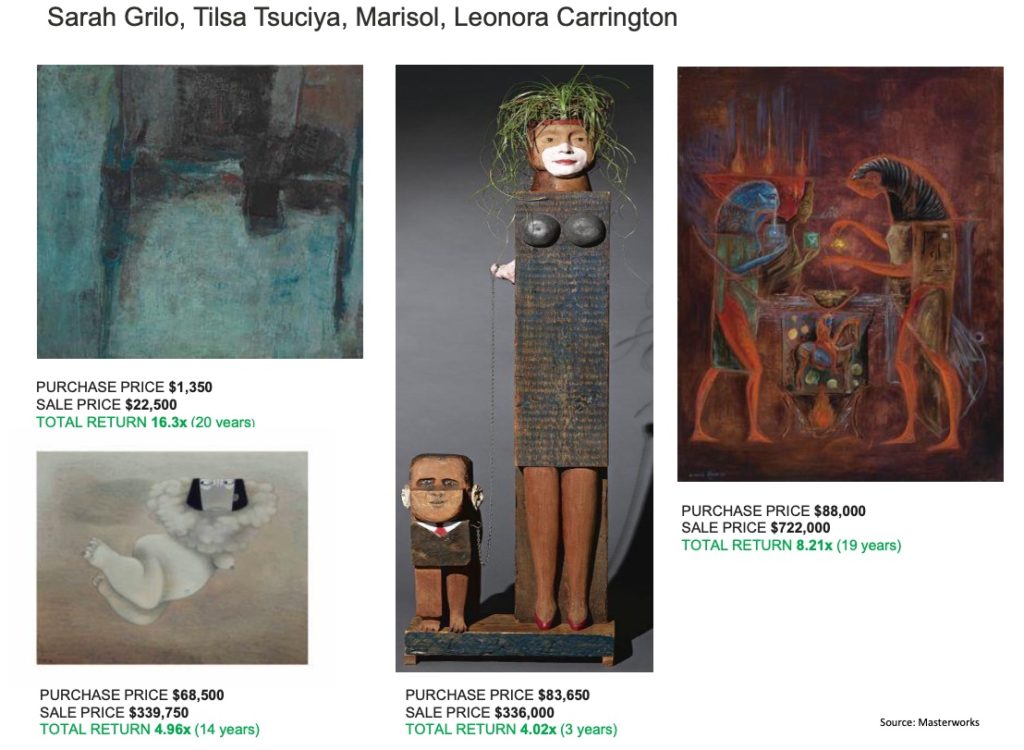

“We want to focus the Delaware-based fund on liquid or active Latin American artists with a defined track record. The sweet spot is between US$1million and US$10million. You get a better risk-adjusted return by focusing on high quality “momentum” artists. We also want to realise value from women artists who we believe are undervalued. LATAM is undervalued period according to our analysis and our algorithm. We are majoring on Uruguay which has a great heritage from the 1930’s as well as being a tech hub and a relatively stable place. The political stability and ease of doing business is something that we take very seriously. This is a massive plus point when it comes to asset allocation. We do though want to pick up gems from vibrant places such as Colombia and Cuba. The latter is at the other end of the spectrum but to its credit has a rapidly emerging art market in the US. But we do not rule out other jurisdictions within LATAM. Every country has their own style and strong points”

It is hardly as if LATAM isn’t on the art map. Both Sotheby’s and Christie’s (and Phillips, since 2009) conduct regular auctions of Latin American art twice a year, in May and in November. US galleries have exhibited works by Latin American artists such as Frida Kahlo (1938), Rufino Tamayo (1937 and 1938), Roberto Matta (1940 and 1943), and Rene Portocarrero (1945). Furthermore, important museums such as the Museum of Modern Art of New York (MoMA) dedicated great exhibitions to Latin American artists like Rufino Tamayo (1931) and Roberto Matta (1957), which were followed by exhibitions of other Latin American artists in museums across Europe (for example, Jesús Soto at the Stedelijk Museum in 1968), and in the U.S.

Hollingworth is adamant that art is an under-utilized asset in asset allocation strategy with the US$1.7trillion market at half the size of Private Equity. In 2019, global sales of art and antiques were estimated at US$64.1 billion. Sales in 2019 through dealers and galleries, respectively, were estimated at US36.8 billion versus US$24.2billion, respectively, at auction houses “It’s surprising that art as an investment isn’t as pervasive or as popular as you might think. This is an opportunity given that art is a scarce asset with forceful demand, especially from Asia” explains Paul.

Demographics in the Developed and Emerging worlds are a driver. In the US, given the rising weight of the Latin community in the overall population, Latin culture and art can gain further traction moving forward. “Being both a Latino and an American is a very rich vein which has enormous potential” says Hollingworth. The Emerging World is generating wealth for potential buyers of art. In Asia, there is a new group of young collectors, in their 30s and 40s; they come often from high tech, they have spending power, enjoy risk-taking, and unlike their forebears, they are less frugal, and focused on contemporary art. Both Social media and going to galleries and museums are important. Credit Suisse estimates that in 2020 there was a 40% jump in new buyers of art. New capital is penetrating the market.

New technologies are catalysts for the market too. Blockchain offers a path towards secured transactions, more democratic ownership, access to provenance and title of registry, as well as transparency around giving. Christies recently launched a NFT, a type of encrypted file run on Ethereum blockchain, which is used to represent a unique asset and is valued as collectors’ items.

“One of our directors, Dean Newman, is a fintech expert as well as a top rated Latin American investment specialist, and we will have deal flow in order to diversify our proposition if the thesis is in the interests of our investors. Diversification and stable locations are important to our risk profile. We must embrace technological change and the art market is moving faster than most” explains Hollingworth.

“This does not detract from our core proposition” notes Hollingworth. “We believe that selective high quality LATAM art assets from established and emerging artists with a track record in the market can be revalued strongly upwards over a 7-10-yr period. We are aiming for an IRR of at least 9% p.a. If I said 20% p.a., I’d sound ingenuous. I’m always wary of outsized propositions. Better to start at a reasonable level, based on doing your research, and outperform expectations. The return can comfortably outstrip global equity markets where a traditional 7% p.a. return will be challenging, based on history. I would certainly hope so anyway. Art is pretty resilient and as a market has been around since the 16th century. Bond markets offer scant compensation for risk while Real Estate is less enticing than in the past. This leaves ART as a low volatility, low-correlated, high risk-adjusted return alternative asset with portfolio diversifier characteristicsand a relatively low loss rate if you focus on the ”winners”.

Hollingworth and The LATAM Art Fund are also committed to ESG. Governance is robust with seasoned professionals in asset management with vast experience of board and committee membership. One director, Andres Bernal, currently a CEO at Grupo Orbis, commands a CV of board membership “as long as your arm”. Air travel will be restricted to the minimum. In addition, 15% of the performance fee will be used to galvanize art scholarship between Latin America and the US and UK and supply donations. ”I wouldn’t be doing this unless there was a benefit for Society. In this case, it’s promoting Latin American art and supporting cultural exchange for art scholars between LATAM and the US and UK”.

With regards management fees, art is still an expensive business and costs need to be covered. “Our management fee is completely consumed by insurance (storage and transit), transportation, airport handling, tax, clearance, and storage. We will store artwork in the US. Where possible, we will have to buy quality in bulk. Where possible, we will endeavor to keep costs as low as possible. We have a taskforce looking at cost-control. But we will not shy away from protecting the assets, at all costs, which after all belong to our investors. We do not pay ourselves top dollar either. We have to achieve merit by delivering the returns that our investors expect”.

Fund Focus: Latin American Art:

Closed End Delaware-based Fund: 10yr term with a 5yr Investment period.

Management and Performance Fee: 2% and 20%*

IRR : 9% p.a.. (Masterworks.io Total Art Index annual return since 1962)

*15% of PF will go towards art scholarship exchange between the US, UK, and South America and donations.

For information, contact: Paul Hollingworth at ph@creative-portfolios.co.uk