Investing in Precious Metals Miners

Part 5 – Gold Mining Appetite

Part of an ongoing discussion with Equinox Partners about investing in precious metals mining.

Equinox Partners is a team of ten professionals based in Connecticut with a 25-year track record, a pedigree that extends to the very inception of value investing, and a specialization in precious metals mining. Today, the firm manages $500m in gold and silver mining equities on behalf of institutional and high-net-worth families.

Unsustainable amounts of debt, increasingly radical monetary policy, and the overvaluation of financial assets have led many investors to consider an investment in gold and silver. Put off by the difficulty of analyzing gold and silver miners, most of these investors are gravitating towards an investment in the metals themselves. Accordingly, the firm has witnessed $863 million of outflows from the junior gold mining index over the last two years and $26 billion of inflows into the gold ETF.

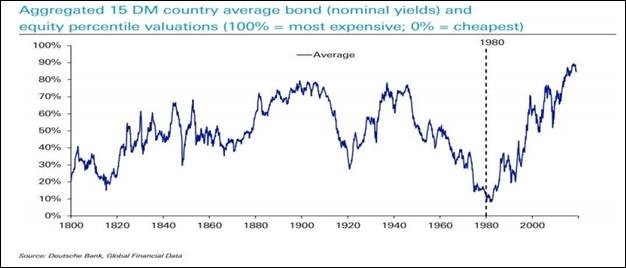

While gold and silver miners have appreciated this year, as a group they remain very undervalued. One easy metric to watch is the price-to-cash-flow ratio for producing miners. Despite the bull market in miners this ratio is less than it was at the beginning of the year. By contrast, most developed market equity indices have risen as their earnings have fallen this year. Developed market bonds, likewise, also remain at nosebleed valuations. The long-term graph below accurately captures the extreme valuation of financials assets across Developed Markets.

Developed Markets’ Bond and Equities at 220 year highs

Skeptics continue to suggested that gold and silver miners are only a trade, and a risky one at that. John Dizard’s Financial Times columns reliably run in this direction, and he is not alone. While Equinox agrees that getting the underlying macroeconomic factors right is essential when it comes to gold and silver mining, this perianal pessimism about gold and silver miners strikes us as more emotional than rational.

From the firm’s perspective, the long-term investment case for gold and silver miners continues to improve even as the metal and shares rally. Debt accumulation and monetary policy remain stuck on an unsustainable path, creating an eventual revaluation scenario for gold and silver similar to what markets experienced in the late 1960 and early 1970.

For information, Daniel Schreck, Partner at Equinox Partners, at dschreck@equinoxpartners.com or 646 833 2783.