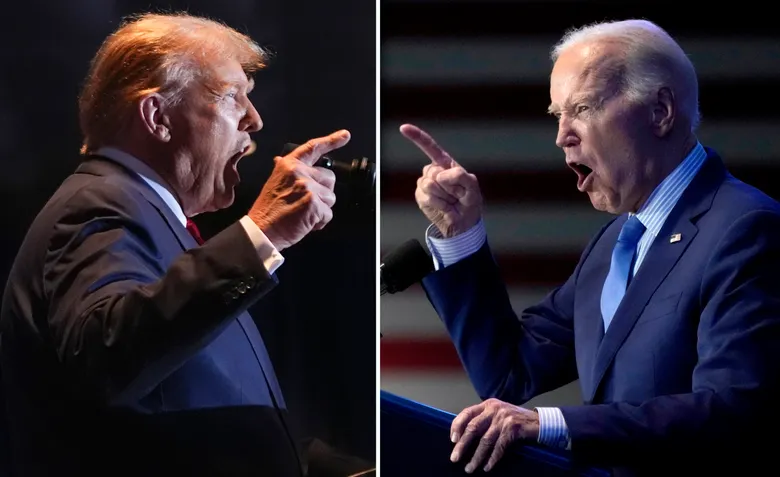

A recent FON member survey reveals that 68 percent of our members are Trump supporters while 23 percent are Biden supporters.

As we approach the 2024 presidential debate, family offices have more at stake than the average viewer. The outcomes of these debates can significantly impact investment strategies, tax planning, and overall wealth management. This post aims to provide family offices with a comprehensive guide on what to watch for during the debates. We’ll cover key topics ranging from economic policies to regulatory changes, and how they could affect the financial landscape for high-net-worth families.

The Importance of Economic Policy

Economic policy is always a critical topic during presidential debates. For family offices, understanding the candidates’ economic agendas can help in forecasting market trends and making informed investment decisions. Pay attention to discussions around fiscal policy, monetary policy, and government spending. These elements are crucial for gauging the potential direction of the economy and its impact on various asset classes.

Tax Reform Proposals

Tax reform is another hot-button issue that can have immediate implications for family offices. Candidates often propose changes to income tax, capital gains tax, and estate tax. It’s essential to listen carefully to these proposals as they can affect wealth preservation strategies. For instance, a proposed increase in capital gains tax might prompt a reevaluation of investment portfolios to mitigate potential tax liabilities.

Regulatory Changes and Compliance

Regulatory changes can alter the landscape for financial advisors and wealth managers. Candidates may discuss new regulations affecting the financial industry, such as changes to fiduciary responsibilities or compliance requirements. Understanding these potential changes can help family offices stay ahead of the curve and ensure they remain compliant with new laws.

Trade Policies and Global Markets

Trade policies are another area where presidential candidates often have differing views. These policies can affect global markets, which in turn influence investment strategies. Family offices with international investments should pay close attention to discussions on trade agreements, tariffs, and foreign policy. A shift in trade policy could impact everything from commodity prices to currency exchange rates.

Healthcare Policies and Their Economic Impact

Healthcare policies can have far-reaching economic implications. Discussions around healthcare reform can affect various sectors, including pharmaceuticals, insurance, and technology. Family offices should consider how proposed changes might impact their investments in these sectors. Additionally, healthcare costs can influence broader economic conditions, affecting everything from consumer spending to government debt levels.

Environmental and Energy Policies

Environmental and energy policies are becoming increasingly important in presidential debates. Candidates’ stances on issues like climate change, renewable energy, and fossil fuels can affect investments in these sectors. Family offices should note any proposed initiatives that could impact energy prices, regulatory environments, or government incentives for renewable energy projects.

Education Policies and Workforce Development

Education policies can indirectly affect family offices by influencing workforce development and, consequently, the economy. Candidates often discuss funding for education, student loan forgiveness, and vocational training programs. These policies can affect labor markets, consumer spending, and long-term economic growth, all of which are important factors for investment strategies.

Social Security and Retirement Policies

Social security and retirement policies are critical issues for many family offices. Candidates may propose changes to social security benefits, retirement age, or pension regulations. Understanding these proposals can help family offices plan for retirement needs and ensure that their strategies align with potential policy changes.

National Security and Defense Spending

National security and defense spending are significant aspects of any presidential debate. These topics can affect various industries, including defense contractors, technology companies, and infrastructure projects. Family offices with investments in these sectors should pay attention to the candidates’ plans for defense budgets and national security initiatives.

Technology and Innovation Policies

Technology and innovation are driving forces behind economic growth. Candidates may discuss policies related to tech industry regulation, data privacy, and support for innovation. Family offices should consider how these policies might affect their investments in technology companies and startups. Additionally, government support for innovation can create opportunities in emerging fields like artificial intelligence and biotechnology.

Immigration Policies and Economic Growth

Immigration policies can have significant economic implications. Candidates’ views on immigration can affect labor markets, consumer demand, and overall economic growth. Family offices should listen for discussions on visa programs, border security, and paths to citizenship. These policies can influence sectors ranging from agriculture to technology and impact the broader economy.

Infrastructure Investment Plans

Infrastructure investment is often a key topic in presidential debates. Candidates may propose large-scale projects to improve transportation, utilities, and communications networks. These investments can create opportunities in construction, engineering, and technology sectors. Family offices should consider how proposed infrastructure plans might impact their investments and the broader economy.

Closing Thoughts on the 2024 Presidential Debate

The 2024 presidential debate offers family offices a unique opportunity to gain insights into potential policy changes and their economic implications. By focusing on the key areas discussed above, family offices can better prepare for the future and make informed decisions that align with their long-term goals. Keep an eye on the candidates’ proposals, assess their potential impact, and adjust your strategies accordingly. For more in-depth analysis and personalized advice, consider booking a consultation with one of our financial experts.